Regional Training Seminar for Latin American Insurance Supervisors ASSAL – IAIS 2023

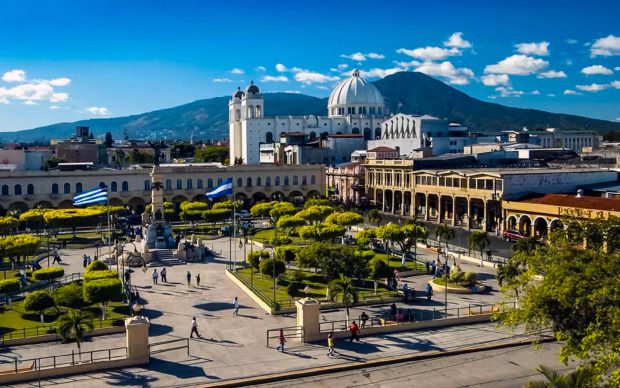

Location: San Salvador, Republic of El Salvador.

From October 5 to 6, 2023, the ASSAL-IAIS 2023 Regional Training Seminar for Latin American Insurance Supervisors will be held at the Real Intercontinental Hotel in San Salvador, organized by the Superintendency of the Financial System of El Salvador, the Association of Insurance Supervisors of Latin America (ASSAL) and the International Association of Insurance Supervisors (IAIS).

Seminar registration link (available up to September 8): https://ssf.gob.sv/seminario-assalsv/

Preliminary Seminar Agenda: here

Hourly Schedule

Draft agenda Day 1 (October 5)

- 7:30 - 8:15

- Registration

- 8:15 - 8:30

- Welcome Remarks

- Evelyn Marisol Gracias, Superintendent of the Financial System of El Salvador

- 8:30 - 9:00

- Keynote Speech: IAIS Activities and Roadmap

- Conor Donaldson, Head of Implementation of IAIS

- 9:00 - 10:30

- Session 1: Experience obtained from the implementation of IFRS 17, Insurance Contracts

- IFRS 17 establishes principles for the recognition, measurement, presentation, and disclosure of insurance contracts that are within the scope of that standard, which aims to ensure that an entity provides relevant information that fairly represents those contracts. This information constitutes a basis for users of financial statements to evaluate the effect that insurance contracts have on the entity's financial position, financial performance, and cash flows. In this regard, this panel will discuss the experience gained by those who have made the most progress in implementing this standard

- 10:30 - 11:00

- Group photo and Coffee Break

- 11:00 - 12:30

- Session 2: Regulation of Insurers´ Investments and Solvency

- The objective of investment regulation is to minimize the risks to which investments are subject so that the institutions always have sufficient resources to meet their obligations to policyholders. The level of management measures makes it possible to reduce regulatory restrictions. However, each country must consider its characteristics to adopt an investment regulation scheme. This session will deal with the new regulations of Insurers´ Investments and Solvency, which exist or should exist in the current context, given the different risks assumed by the entities

- 12:30 - 14:00

- Lunch

- 14:00 - 15:30

- Session 3: Climate Risk (Session A2ii)

- Insurance supervisors have good reasons to take effective measures to promote resilience to climate risks and natural disasters, particularly among the poor and other generally excluded segments. These arise both from the need to fulfill their mandates and to act as stakeholders in achieving broader objectives, for example, those related to national disaster risk management policies and the UN Sustainable Development Goals (SDGs). This session aims to contribute to the topic by sharing ideas and stimulating discussions on what the roles of overseers may be in this context

- 15:30 - 16:00

- Coffee Break

- 16:00 - 17:30

- Session 4: Innovative Insurance Products

- Artificial Intelligence (AI) is transfiguring various entities, including insurance companies, by performing tasks that were previously only done by humans, such as learning, decision making, and pattern identification. This session will explain the advances and what is expected in this regard in the coming years in the insurance industry

- 19:00 - 21:00

- Gala Dinner

Draft agenda Day 2 (October 6)

- 8:30 - 10:00

- Session 5: Reinsurance and Other Forms of Risk Transfer

- Reinsurance as a risk transfer instrument for insurers and its implications in the following areas: 1. Catastrophic Reinsurance - Calculation of Probable Maximum Loss and Experience with recent catastrophes; 2. Reinsurance supervision under the risk-based approach; 3. The role of supervisors in the face of natural catastrophes, how to determine protection gaps against the risk of natural disasters

- 10:00 - 10:30

- Coffee Break

- 10:30 - 12:00

- Session 6: Actuaries and Statistics

- How to calculate the technical reserves and the variables to be considered for the determination of microinsurance premium rate. Calculation of mathematical reserves for life insurance with premium return and consequences of not calculating such reserves. Consequences of insufficient premiums for life and property & casualty insurance

- 12:00 - 13:00

- Lunch

- 13:00 - 14:30

- Session 7: Prevention of Money laundering / Terrorist Financing

- The digital transformation that financial markets have experienced globally has driven the development and implementation of technological tools, such as Artificial Intelligence (AI), Machine Learning (ML), and InsurTech, which are rapidly changing the way compliance is practiced and financial crimes are prevented. This session will focus on the current and future efforts of the insurance industry in combating Financial Crime and presentation of case studies applied to the insurance industry on risk management to prevent financial crime and virtual currencies

- 14:30 - 15:00

- Closing Remarks

- 15:30 - 20:30

- Departure to closing dinner