San Salvador, October 10, 2025. —The 2025 ASSAL–IAIS Regional Insurance Supervisors Training Seminar concluded with great success in El Salvador, a two-day event that brought together representatives from 22 countries, insurance supervisory authorities from the region, members of the Salvadoran and continental insurance industry, and prominent international experts.

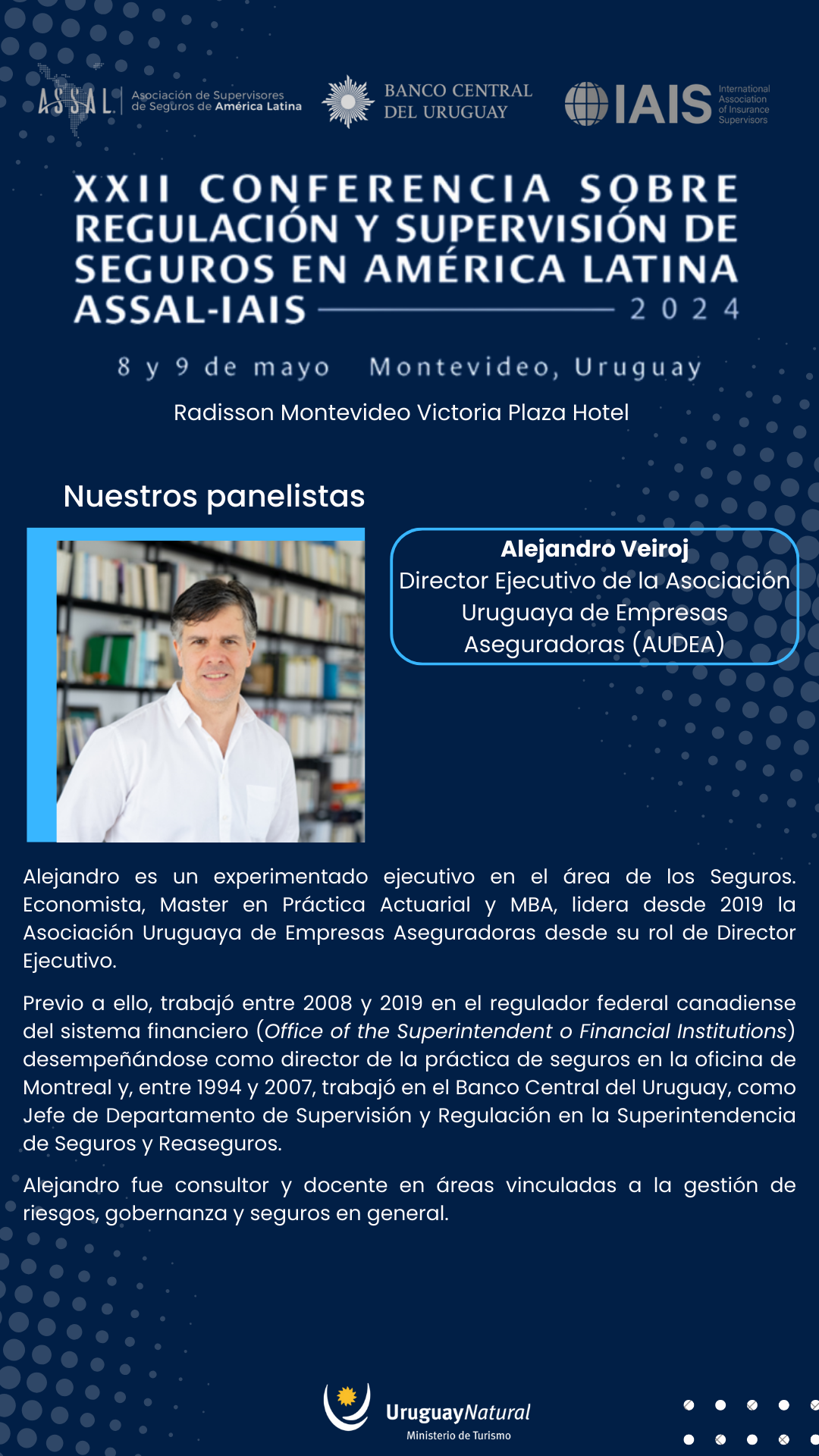

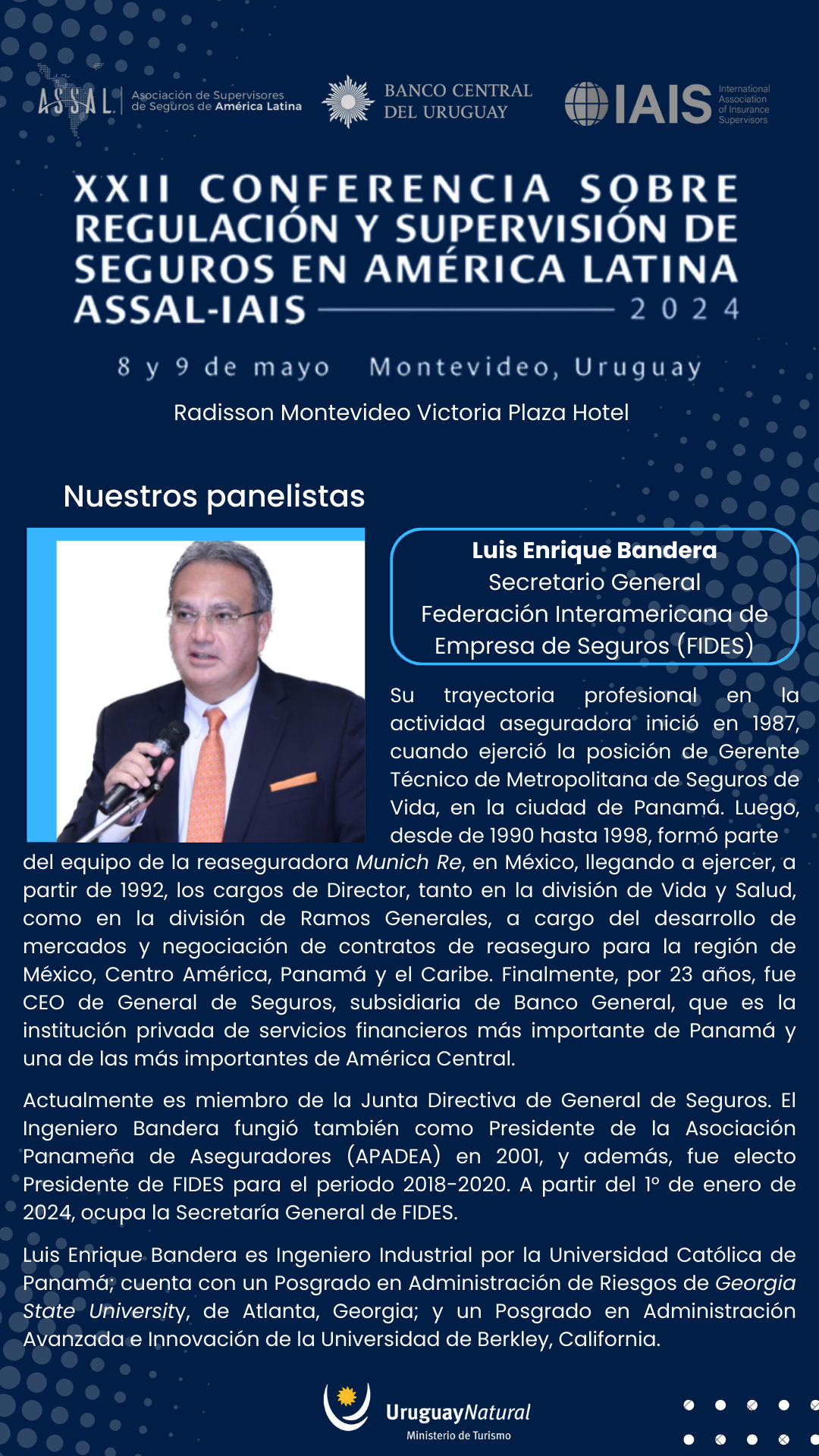

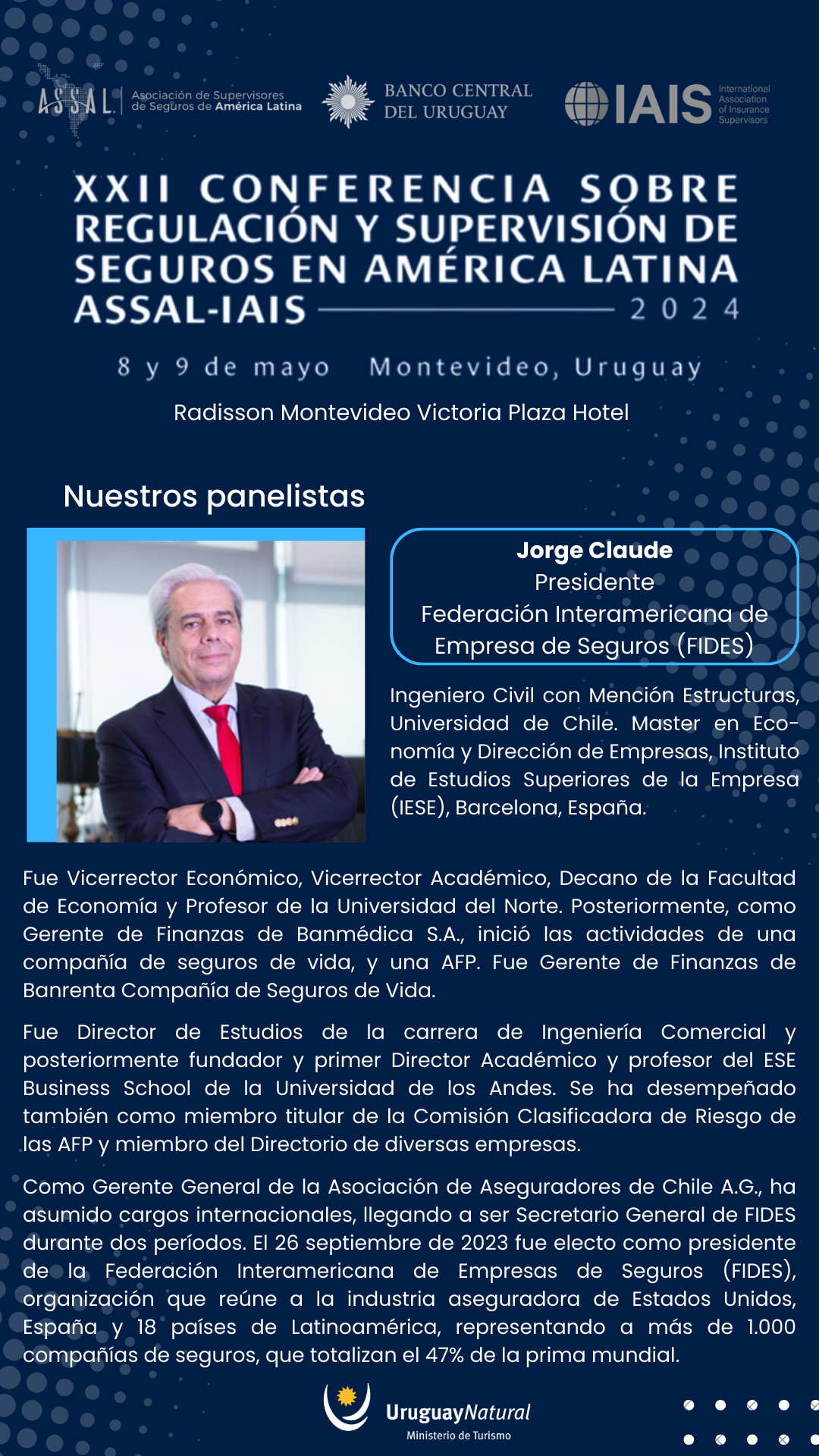

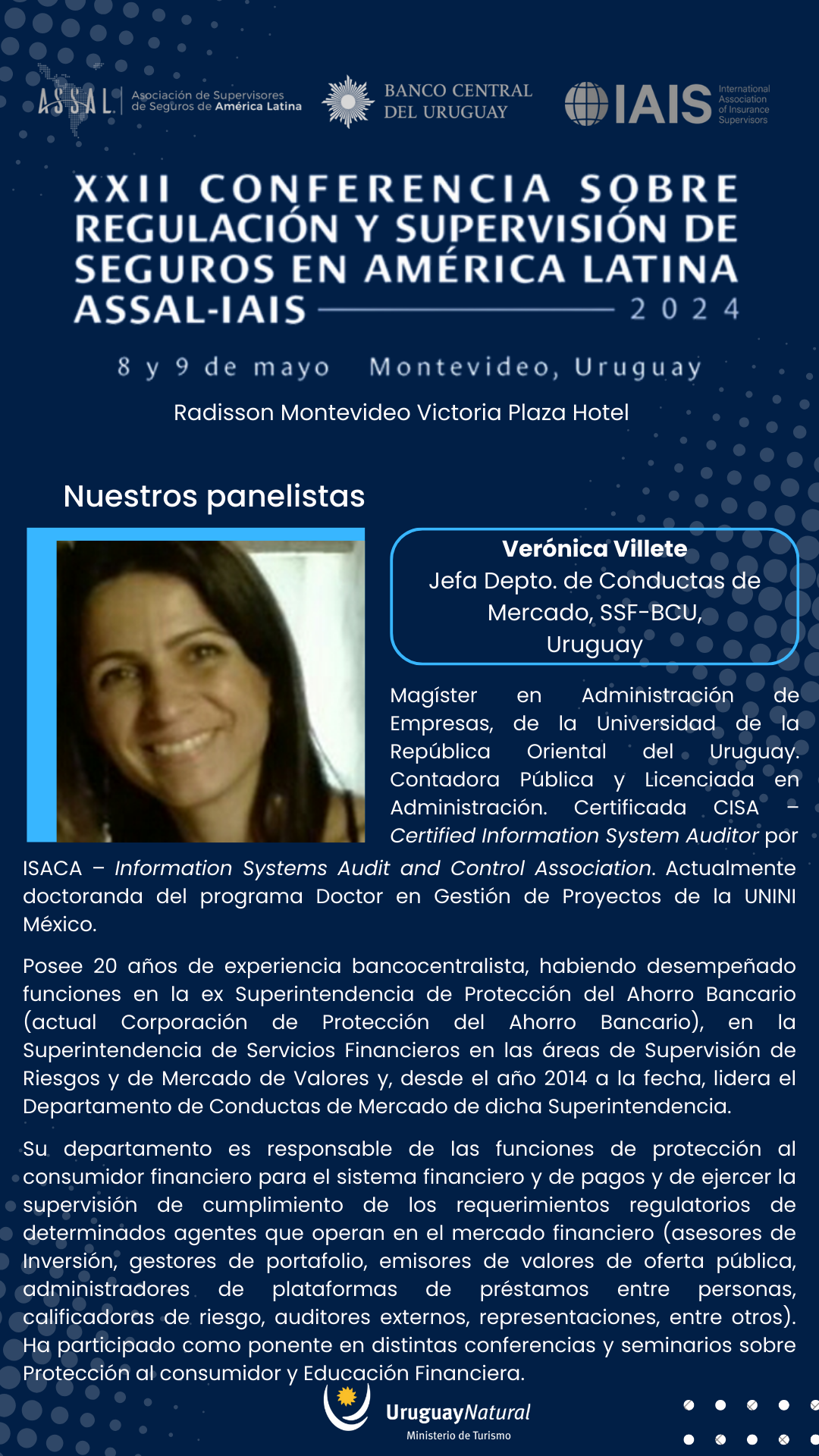

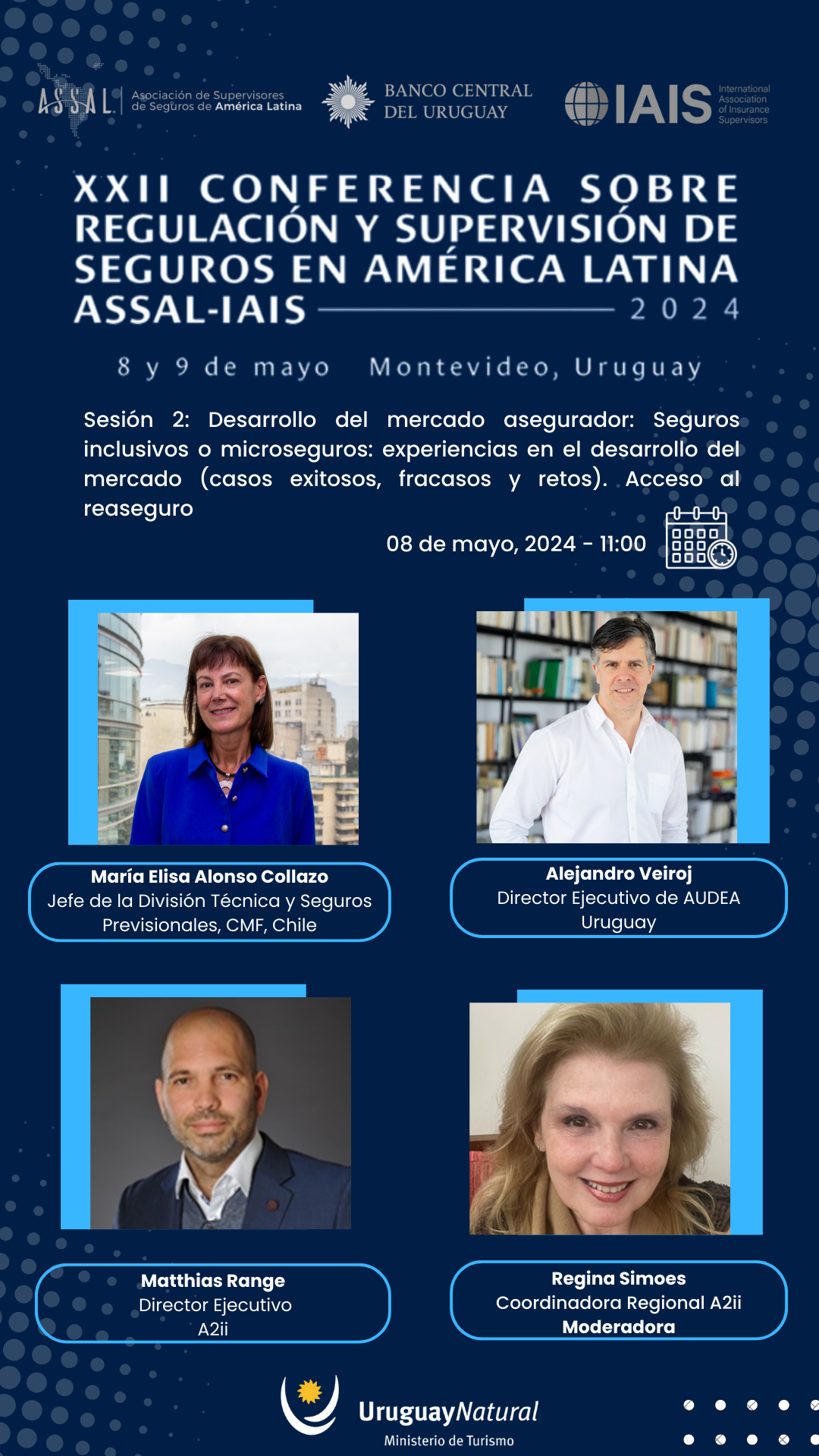

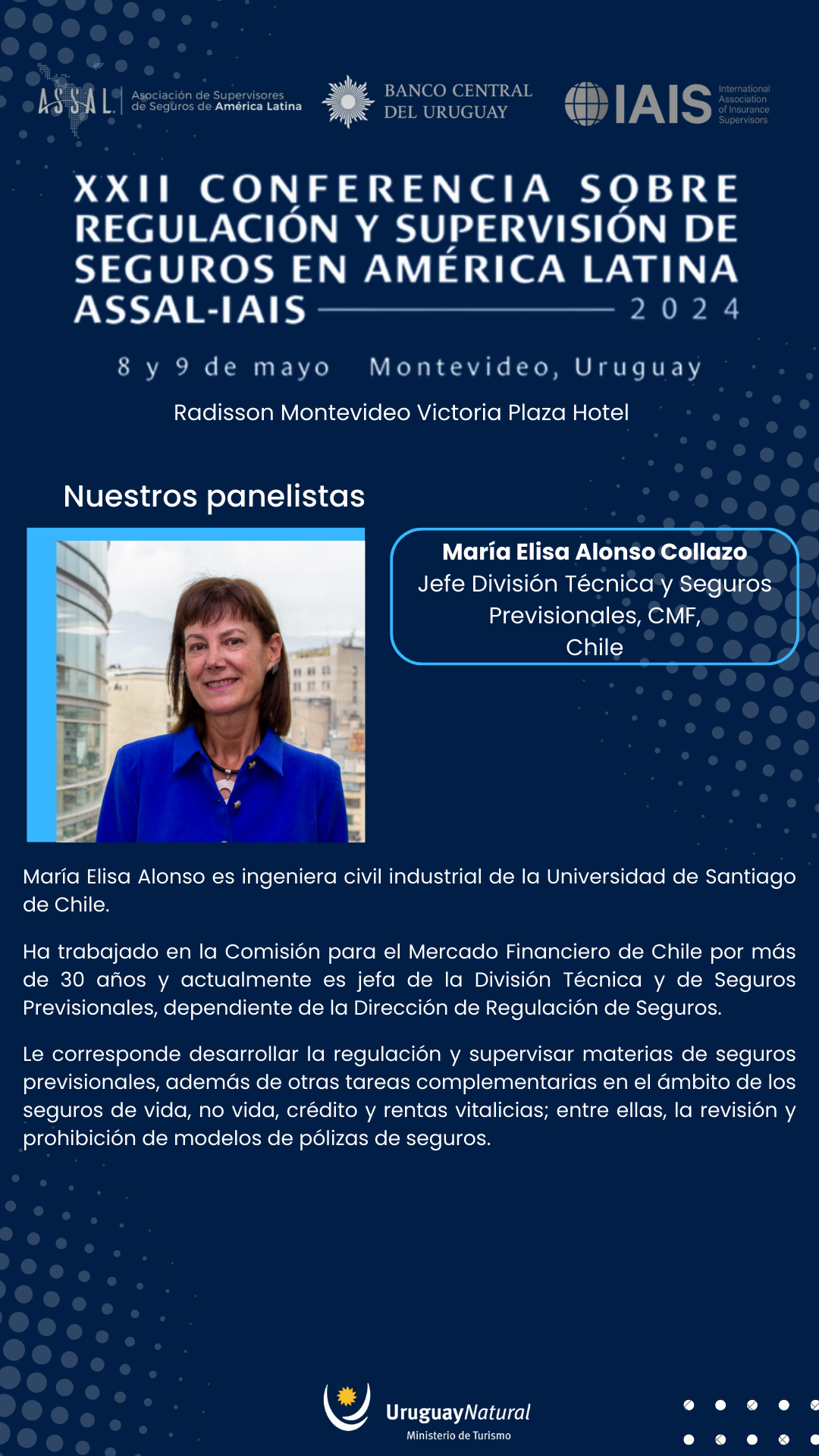

The event, jointly organized by the Association of Latin American Insurance Supervisors (ASSAL), the IAIS – International Association of Insurance Supervisors , and the Superintendencia del Sistema Financiero dof El Salvador, featured the valuable participation of panelists from international organizations such as IAIS, the National Association of Insurance Commissioners (NAIC), the Access to Insurance Initiative (A2ii), the Federación Interamericana de Empresas de Seguros (FIDES), Toronto Centre, ASSAL member authorities and members of the insurance industry.

During the two days of the event, the panelists addressed topics of great relevance for strengthening the supervision and regulation of the insurance market, including: digitalization and the use of new technologies, artificial intelligence and Big Data applied to risk assessment in insurance companies; best practices in the supervision of reinsurance contracts; financial protection and life and health insurance coverage in uncertain economic environments; advances in the implementation of IFRS 17 and Solvency II in the region; management of actuarial risks in EMDE country markets and practical tools for supervisors; financial inclusion through microinsurance; the results of products covering climate and natural disaster risks; and the principle of proportionality in insurance supervision.

The 2025 ASSAL–IAIS Regional Insurance Supervisors Training Seminar established itself as a space for technical dialogue and cooperation, promoting the exchange of experiences and knowledge among supervisory authorities, international organizations, and the insurance industry.

The ASSAL Executive Secretariat expresses its recognition to all panelists and participants for their valuable contributions, and extends special thanks to the Superintendency of the Financial System (SSF) of El Salvador for its outstanding role as host of the event, reflecting the country’s commitment to strengthening insurance supervision and regional cooperation.

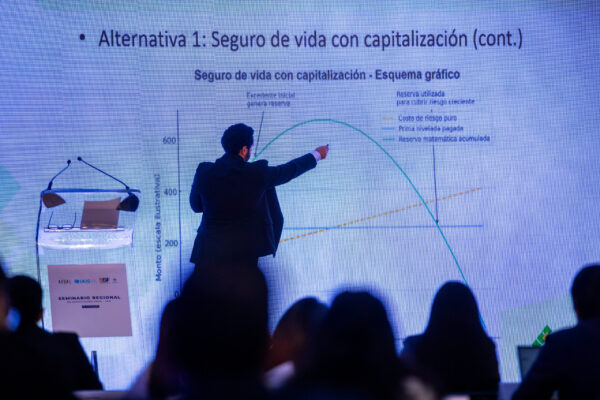

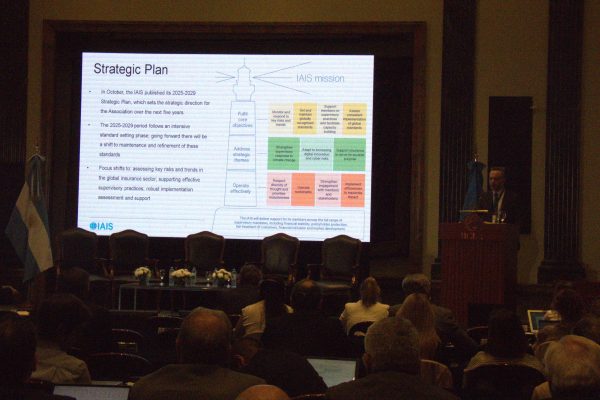

Below, you can enjoy the photos from the event: